Recent news has highlighted Raksul’s Management Buyout (MBO), with a Goldman Sachs-backed fund launching a Tender Offer (TOB) at ¥1,710 per share. For many, terms like “MBO” and “TOB” may be unfamiliar, so this article breaks down the key concepts in a simple, easy-to-understand way.

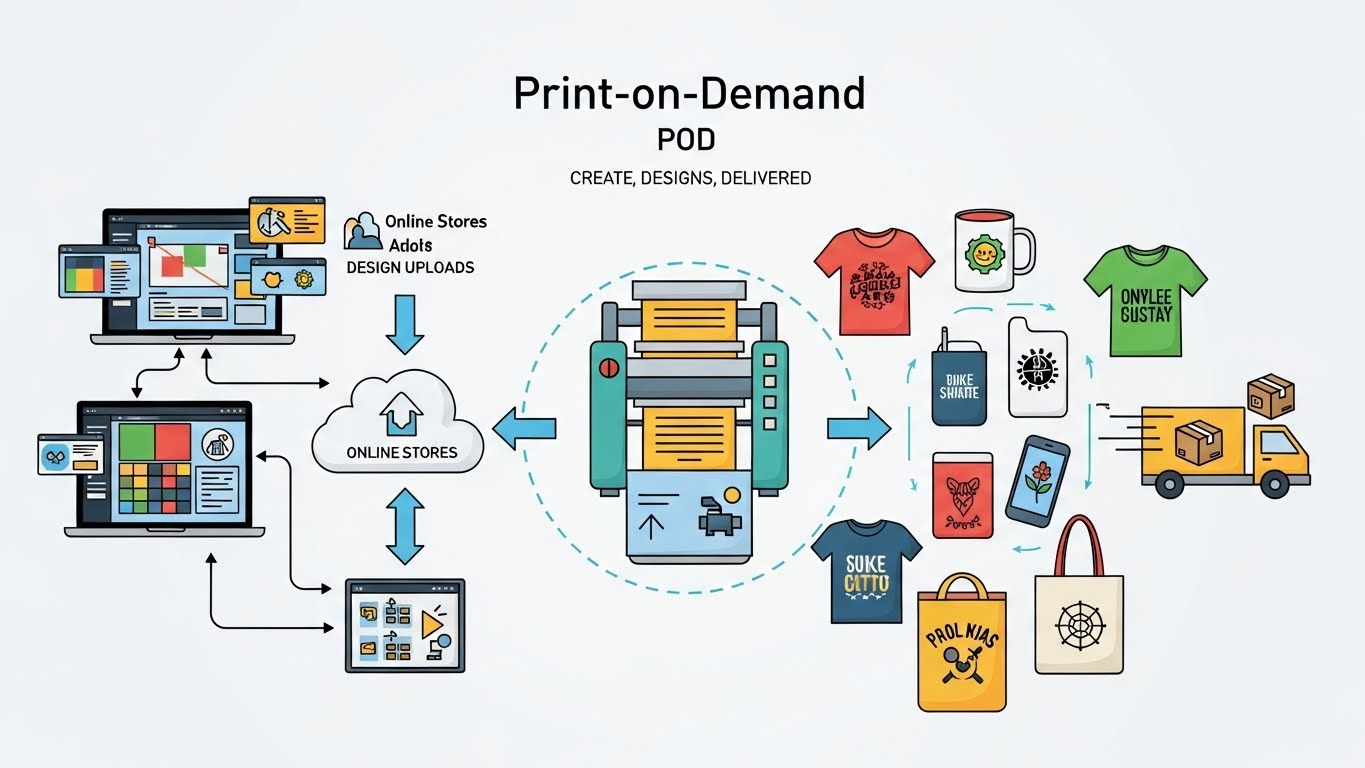

What is Raksul?

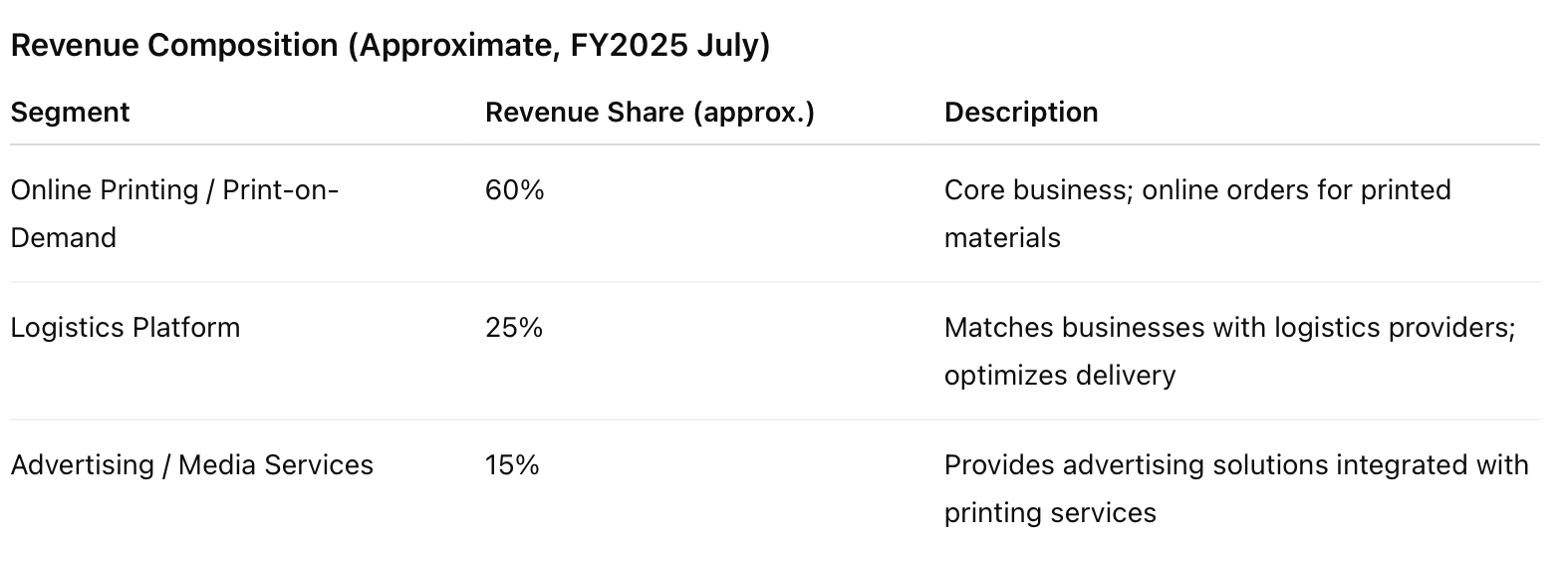

Raksul is a company that introduces digital technology to traditional industries to improve efficiency. Founded in 2009 and based in Tokyo, it operates several business segments. Its main businesses and approximate revenue composition are as follows:

Raksul is a company that introduces digital technology to traditional industries to improve efficiency. Founded in 2009 and based in Tokyo, it operates several business segments. Its main businesses and approximate revenue composition are as follows:

Note: Figures are rough estimates based on the latest financial reports and chatGPT. The printing business is Raksul’s largest revenue driver, while logistics and advertising services support growth and diversification.

Note: Figures are rough estimates based on the latest financial reports and chatGPT. The printing business is Raksul’s largest revenue driver, while logistics and advertising services support growth and diversification.

What does Raksul’s MBO mean?

Raksul’s management, together with an external fund (in this case, a Goldman Sachs-backed fund), will buy shares from existing shareholders, taking the company private. In other words, the expected shareholder composition before and after the MBO is as follows:

Raksul major shareholders (as of July 2025):

- Japan Master Trust Bank (Trust Account): 13.71%

- Yasuhisa Matsumoto (Chairman): 12.63%

- Japan Custody Bank (Trust Account): 12.23%

- MSIP Client Securities: 10.28%

- Other institutional and individual investors

Expected shareholder composition after MBO:

- Goldman Sachs-backed fund (RI): majority and controlling shareholder

- Management (including CEO Nagami and Chairman Matsumoto): remain as key shareholders

- Other existing shareholders: may sell through the TOB or be bought out via a squeeze-out

Note: The final shareholding percentages will be disclosed in the official Tender Offer results, usually within 1–2 weeks after the offer closes.

Squeeze-out: A process where remaining minority shareholders are forced to sell their shares to the company or major shareholders.

What does the ¥1,710 TOB mean?

The Goldman Sachs-backed fund is offering to buy Raksul shares at ¥1,710 each, higher than the current market price (~¥1,226 at the time of reporting). In short:

- This represents a premium of about ¥480 per share (~40% above market price)

- For shareholders, especially minority and individual investors, it is an attractive opportunity to sell at a higher price

- If the offer succeeds, management and the fund will hold most of the company’s shares, allowing Raksul to delist

Why is Raksul doing an MBO?

Raksul has been a publicly listed company, but the MBO is motivated by several factors:

- Focus on long-term strategy

- Public companies are often constrained by quarterly reporting and short-term stock price evaluations

- Taking the company private allows focus on long-term growth investments and business restructuring

- Relief from market pressure

- Stock price declines can put pressure on management

- Post-MBO, management can make decisions independently

- Greater flexibility in capital policy

- Freed from listing requirements and disclosure obligations

- Easier to implement stock options and employee share schemes

- Funding support from a sponsor fund

- The Goldman Sachs-backed fund provides the capital for the MBO

- Large acquisitions or business investments can proceed more quickly

Summary

Through the MBO, Raksul can operate free from the constraints of being listed, focusing on long-term management strategy and business investment. At the same time, with fund participation, management may face certain influences on decision-making.

Through the MBO, Raksul can operate free from the constraints of being listed, focusing on long-term management strategy and business investment. At the same time, with fund participation, management may face certain influences on decision-making.

This MBO and TOB represent a significant step toward taking Raksul private.

コメント